Insurance & Remodeling 101

The 101 on Homeowner’s Insurance & Remodeling

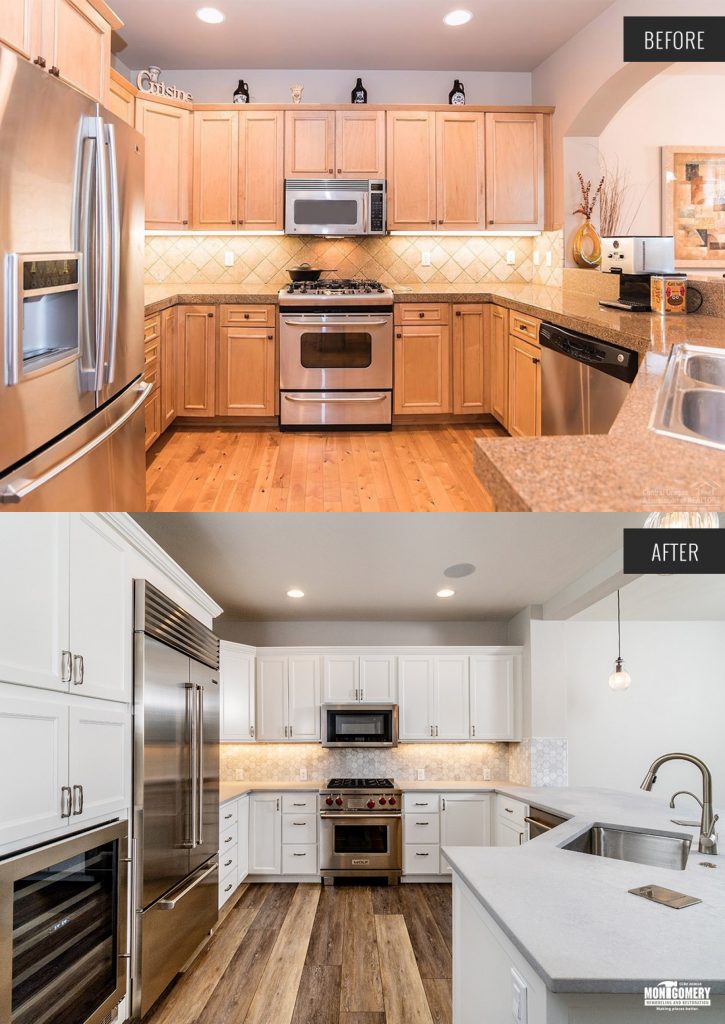

Planning a home remodel can involve fun activities, such as designing a new floor plan or picking fixtures and paint colors. Having a heart-to-heart with your home insurance carrier may not be part of your preparations, but it should be.

If you’re getting ready to remodel, here are some things about your insurance you need to know before you get started.

Let your insurer know

The value of your home will likely go up with the remodel, and your coverage limits may not be high enough if your home is damaged or destroyed. Talk to your insurance agent about your renovation plans before getting started to find out how and when to update your coverage.

Check if you need extra insurance

Find out how you’re covered for liabilities, like if a contractor or friend gets injured in your home, and talk with your agent about whether it’s enough. Remodels increase the likelihood of someone getting hurt, and most standard homeowners’ insurance policies aren’t cut out to handle that level of liability.

Can builders’ and contractors’ insurance cover yours?

Before starting the project, have a chat with your contractor or builder to see if their insurance covers the whole structure or just the part they’re working on. If they only have partial cover, it could be worth asking if you could pay them a bit more to upgrade the coverage to include your whole home.

DIYers may need extra coverage

Most policies won’t cover homeowners undertaking their own remodels. If you are undertaking any part of the renovation project yourself, or coordinating as a project manager, then you may need builder’s insurance. It’s best to check with your insurer to see what they say.

Thinking of moving out while renovating? Think again!

Living through a remodel can be a nightmare, which is why it’s common to move out while renovating. However, some policies will become void if your home is unoccupied for longer than a specific amount of time, typically between 30 and 90 days.

If you’re thinking about moving out while you upgrade your kitchen and bathroom, you may need to think again. Some policies can lapse after just 30 days.

And after remodeling, make sure to update your policy

After the remodel is finished and you’ve popped the champagne, contact your insurer to update your home and contents policy. If you were to accidentally damage your new marble bench or your new floor-to-ceiling window was to get smashed, it’s good to know you’re covered.

Policy coverage and restrictions can vary from one state to another, and from one carrier to another, so before you undertake any home remodeling projects, call your agent — and take a few minutes to see what other homeowners have to say about their insurance companies.

Huge thank you to Consumer Advocate for this guest blog post!

Sorry, the comment form is closed at this time.